Mastering Money Management: A Guide for Small Business Owners

Read Time 7 mins | Written by: Kenneth Hough

In today's fast-paced business world, managing finances efficiently is crucial for small business growth and sustainability. Mike Michalowicz's Profit First system has revolutionized financial management for business owners, offering a practical, easy-to-follow methodology. Building on this approach, I'm thrilled to introduce the Money Management Matrix, a complementary tool designed to enhance financial clarity and control.

Unlock Financial Mastery with Your Free Money Management Matrix!

Understanding the Importance of Money Management

Effective money management is vital for small business success. It involves meticulously tracking and controlling financial activities, including income, expenses, and investments. By mastering money management, owners can ensure their business's financial stability and growth, maintain healthy cash flow, avoid debt, and maximize profitability. Without it, businesses risk cash flow problems, inability to meet financial obligations, and lost growth opportunities.

Proper money management allows small business owners to have a clear overview of their financial situation, identify areas of improvement, and make necessary adjustments to achieve their business goals. It helps in maintaining a healthy cash flow, avoiding unnecessary debt, and maximizing profitability.

Without effective money management, small businesses may face cash flow problems, struggle to pay bills and employees, and miss out on growth opportunities. Therefore, it is essential for small business owners to prioritize money management and learn strategies to effectively manage their finances.

Introducing the Money Management Matrix

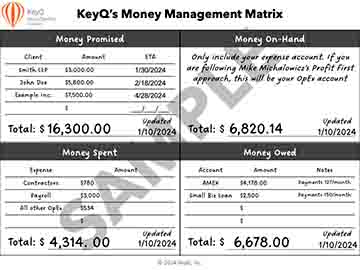

The Money Management Matrix is a streamlined, one-page dashboard divided into four quadrants: Money Promised, Money On-hand, Money Spent, and Money Owed. Designed to provide a quick snapshot of your company's financial health, it perfectly complements the Profit First model's focus on cash management, empowering you to make informed decisions with real-time data.

The Money Management Matrix should act like the dashboard on your car. By glancing at your total numbers, you will be able to determine the financial health of your company. If the numbers don't balance then it should set off a virtual alarm in your head, similar to the lights and alarms that go off when your tire pressure is off, or the seat belt hasn't been buckled but your in drive.

By using the Money Management Matrix, small business owners can gain a better understanding of their financial health and make informed decisions based on real-time data. The matrix helps in identifying areas of overspending, optimizing revenue streams, and ensuring that profit is prioritized from the start.

The Money Management Matrix is a simple yet powerful tool that can revolutionize the way small business owners approach financial management. By implementing this tool, business owners can take control of their finances and set themselves up for long-term success.

Implementing the Money Management Matrix in Your Small Business

Integrating the Money Management Matrix into your business is straightforward. It involves categorizing your financials into four key areas: Money Promised (expected income or accounts receivable), Money On-hand (current balance in your OpEx account), Money Spent (breakdown of monthly expenses into Contractors, Payroll, and Other OpEx), and Money Owed (liabilities like loans and credit cards). Regularly update this matrix, ideally in line with the Profit First model's recommended schedule, to maintain a clear view of your financial health. Remember, the goal of this matrix is to serve as a dashboard, similar to the dashboard of your car. It should be intuitive enough that if the numbers don't add up (for example, if your expenses outweigh your income), it should trigger a virtual alarm in your mind like a check engine light or a seat belt alarm.

Let's go over each of the quadrants, start at the top left.

1. Money Promised

Starting with 'Money Promised,' this quadrant tracks accounts receivable, giving you a clear picture of expected income. If you are not sure what accounts receivable is, or your business uses the cash accounting method, then consider this the amount of money your clients promise to pay you once you deliver. For example, if I am working on a marketing plan for John Smith and he promises to pay me $3,000 once I deliver the plan, I would jot this down in the 'Money Promised' section along with an ETA of when I should expect the funds. This serves as a reminder of how much money is coming in so you can cross check with your expenses and money on-hand.

2. Money On-hand

Next, 'Money On-hand,' aligned with Profit First's principles, shows the current balance in your Operating Expenses account, emphasizing the importance of understanding your available funds. In this quadrant, only include your expense account (such as your OpEx account if you follow Mike's Profit First model). Do not include your profit, income, tax, vault or other account - only your expense accounts! The goal here is to get an idea of how much liquid cash is available to cover expenses.

3. Money Spent

'Money Spent,' or what we used to call Monthly Expenses, breaks down your spending into three categories: Contractors, Payroll, and Other OpEx, offering a transparent view of where your money goes each month. By breaking down your expenses to three categories, you get a bird's eye view of your overall spending, and where the majority of your money is going. If you see that your expenses are larger than what you are making (hence the accumulation of debt), it's time to revisit your expenses and cut out anything that you do not need. More on this in the "Strategies for Effective Expense Management" section below.

4. Money Owed

Lastly, 'Money Owed' presents a clear picture of your liabilities, such as loans, credit cards, and accounts payable. Again, if you use the cash accounting model, then you can ignore accounts payable and just list any loan or credit card accounts you have. If you borrowed money from friends, family or other investors, list them here too. Use this section as a metric of your progress towards paying down debt, and a reminder not to accumulate anymore. Yes, put that credit card down. Stick it in a freezer. Give it to a reliable friend or family who can stow it away for you. Or simply run it through the shredder so you can't use it.

Tally it All Up

For each section, make sure to tally up the total amount so you can get the big picture. Update this matrix twice a month. If you follow Mike's Profit First model, you should update this matrix on the 10th and 25th of every month. This way, you always have a general idea of your business's financial health and you will be able to focus on running your business.

Once you have completed each quadrant, you can glance at each section to get an idea of your company's financial health. For example, if your 'Cash On-hand' exceeds the amount of your monthly expenses listed in 'Money Spent', congratulations! You have built up a reserve, which gives you the opportunity to reevaluate your CAPS at the end of the quarter. On the other hand, if you are cutting it short with your 'Cash On-hand' and stressed about making it through the month, take a glace at your 'Money Promised' quadrant. Is there any income promised from clients coming in this month or soon? If so, focus on completing their projects early so you can get paid. If not, it's time to focus on sales and client conversion - check out Fix this Next, another great book by Mike Michalowicz!

Strategies for Effective Expense Management

Beyond being a standalone tool, the Matrix enhances the Profit First Instant Assessment. It's essential to prioritize and manage expenses wisely, negotiate with suppliers, and implement cost-saving measures. By doing so, you optimize resource allocation, contributing to better financial performance.

Effective expense management is a vital component of successful money management for small business owners. By implementing the following strategies, you can optimize your expenses and improve your business's financial health:

1. Prioritize essential expenses: Identify and prioritize expenses that are necessary for the operation and growth of your business. Cut back on non-essential expenses to free up funds for more critical areas. It's OK to cut too much as it's always easy to add back expenses.

2. Negotiate with suppliers: Regularly review your supplier contracts and negotiate for better pricing or terms. Consider switching suppliers if it can result in cost savings without compromising quality.

3. Implement cost-saving measures: Look for opportunities to reduce costs without sacrificing quality. This can include energy-efficient practices, remote work options, or leveraging technology to streamline operations.

By implementing these strategies, small business owners can effectively manage their expenses and allocate their resources more efficiently, ultimately leading to improved financial performance.

Maximizing Profitability with Cash Flow Management

Cash flow is the lifeline of your business's profitability. Effective management involves forecasting, optimizing accounts receivable, and managing accounts payable. By adopting these strategies, you ensure enough funds are available for expenses, growth, and profit generation.

Here are some key strategies for maximizing profitability through cash flow management:

1. Forecast and plan: Develop a cash flow forecast to project your business's future cash inflows and outflows. This will help you anticipate potential cash shortages and plan accordingly. Regularly update your forecast to reflect changes in your business's financial situation.

2. Optimize accounts receivable: Implement strategies to improve your accounts receivable process, such as setting clear payment terms, sending timely invoices, and following up on overdue payments. This will help you minimize late payments and improve your cash flow.

3. Manage accounts payable: Negotiate favorable payment terms with your suppliers to optimize your cash flow. Consider taking advantage of early payment discounts if it aligns with your financial goals.

By implementing these strategies and adopting a proactive approach to cash flow management, small business owners can maximize profitability and ensure the long-term financial success of their businesses.

Conclusion

The Money Management Matrix is more than just a tool; it's a guide to enhanced financial health and business sustainability. When used alongside the Profit First model, it offers deeper insights into your business's finances, ensuring every dollar is effectively utilized for growth. Embrace this approach for a financially stable and profitable business future.

Unlock Financial Mastery with Your Free Money Management Matrix!

Kenneth Hough

Background

I founded KeyQ in March of 2020 with the vision of helping businesses achieve the next level of success through delivering innovative and meaningful cloud solutions. Since its inception, I have worked with several businesses, non-profit organizations, and universities to design and build cloud applications that have helped streamline their business processes and reduce costs.

Prior to KeyQ, I was a medical researcher at the University of Alabama at Birmingham (UAB) in the Division of Pulmonary, Allergy, and Critical Care Medicine. UAB is also where I worked on my doctoral thesis under the mentorship of Dr. Jessy Deshane and Dr. Victor Thannickal. During my doctoral work at UAB I was exposed to the “omics” and big data, which has influenced my career choice to develop data-driven analytics platforms in the cloud.

I also have to give a big shoutout to my undergraduate education at Worcester Polytechnic Institute (WPI), where I majored in biochemistry. WPI’s motto is “Lehr und Kunst,” which roughly translates to “Theory and Practice” or “Learning and Skilled Art.” WPI truly cherishes and upholds this pedagogy, which can be seen by the teaching styles and class sizes. The learning experience I had at WPI is unique and has shaped me to be who I am, being able to learn, practice and apply.

Personal Interests

I love to learn innovative technologies and try new things. I have a broad area of interests that include serverless architectures, machine learning, artificial intelligence, bioinformatics, medical informatics, and financial technology. I am also working towards my CFA level 1 exam for 2021. Other interests and hobbies include traveling, rock climbing, rappelling, caving, camping and gardening!